Bonds and Interest

Value of Proportional Production Relative to Time.

Legally, promises may be contracts.

Investing and Spending with Debt. The common knowledge of debt is an obligation. I am not an accountant however the definition that contemporary society uses is much more broad. This country and other countries around the world engage in debt funded expenditures and investments. Social programs elevate the base debt to GDP ratios with revolving debts which bridge a year of advanced payable receipts. At which point does the burden on the indivdual of having to shoulder the payments and responsibility for those who are unable or unwilling to discern between objectivity and subjectivity become the destruction of production, wealth, opportunity, freedom, and liberty. A road is shared and so is an investment in low income populations who would otherwise be consumed themselves by survival instead becoming developed. What is not shared are public expenditures for personal enrichment and frivolous spending which have a negative value to both the corrupted and the burdened.

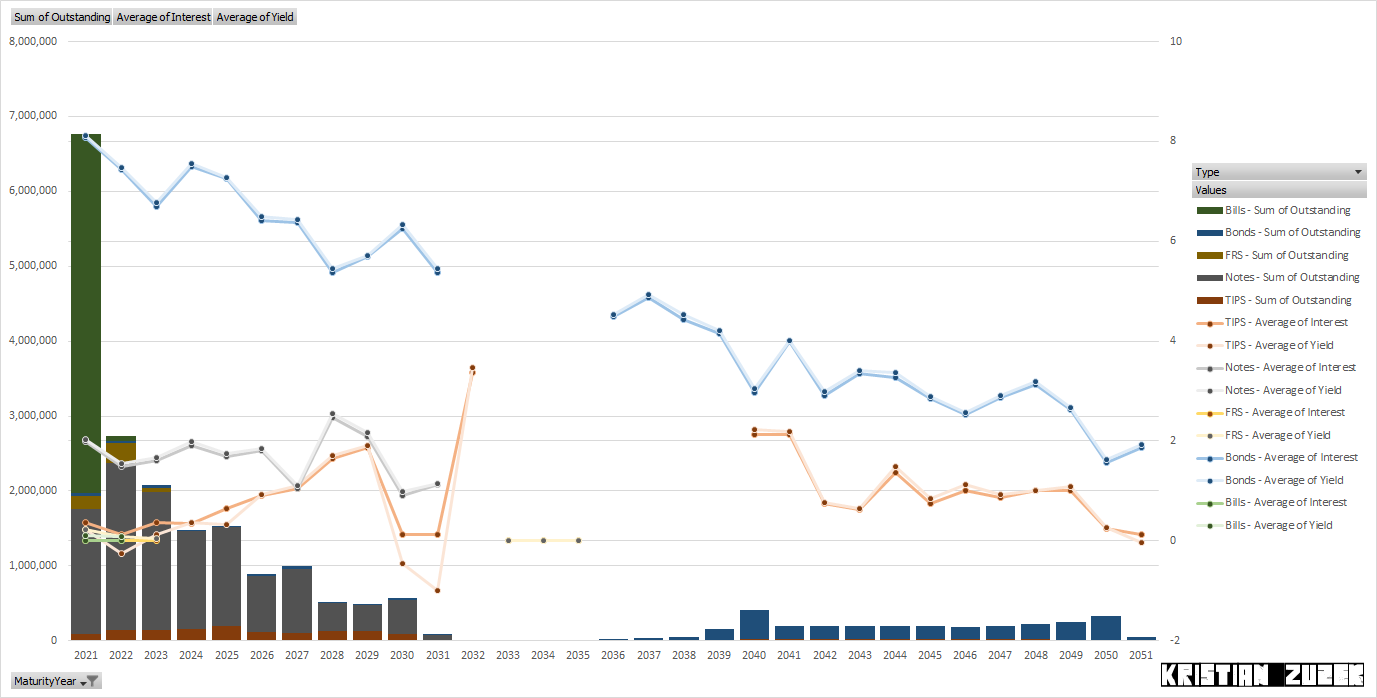

Historical Summary and Decade Forecast

| Series | Value | Interest Rate | Yield | Marketable | Holding |

| TIPS | 1559988.58986745 | 0.906914893617021 | 0.807063829787234 | Marketable | Public |

| Notes | 11195839.0445 | 1.68482905982906 | 1.74265811965812 | Marketable | Public |

| FRS | 500292.2496 | 0.0987272727272727 | Marketable | Public | |

| Bonds | 2919638.9002 | 4.11867088607595 | 4.1775417721519 | Marketable | Public |

| Bills | 4859032.4356 | 0.106574074074074 | Marketable | Public | |

| Intragovernmental | 6123115.35837905 | Non-Marketable | Intragovernmental | ||

| Public | 587352.13905015 | Non-Marketable | Public | ||

| Other Debt | 2826.84589661 | Non-Marketable | Public | ||

| Total | 27748085.5630933 | 2.23680494650734 | 1.38651301367972 | Federal Debt | Total |

Current United States Federal Debt stands at over $27 trillion. (as of 2021-03-17)

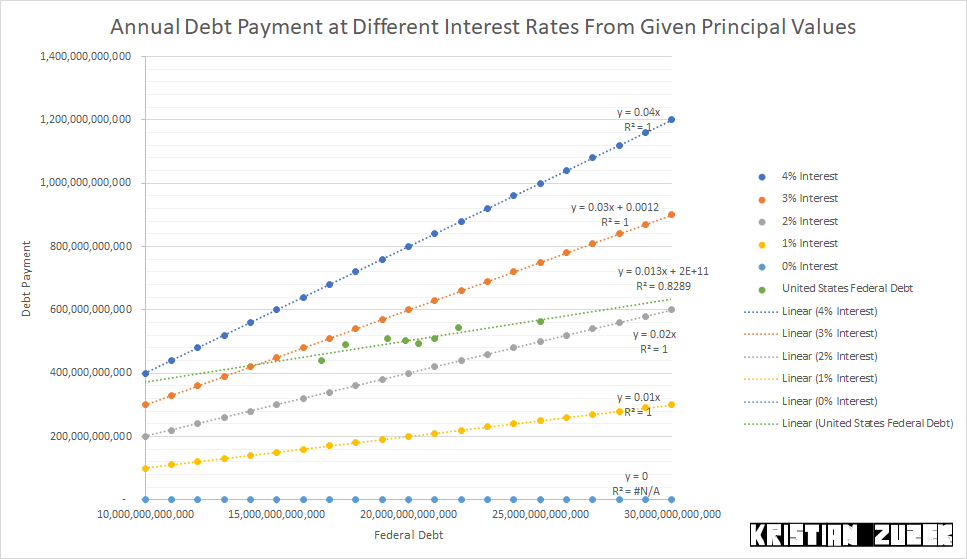

At a current debt level of $27,748,085,000,000 having a 2% interest rate, annual debt payments would be $554,961,700,000 according to calculations made with public data. Previous White House Budgets show a lower annual debt payment.

Conclusion

As has been true since and before exchanges of goods began being transacted in financial terms instead of barter, high debt levels can be managed with lower interest rates.Adding debt raises GDP in numbers. I find it difficult to identify debt which is paid over a horizon and debts which revolve year to year elevating Debt to GDP ratios.

Underwriting technology which does not deliver real growth is not a good use of debt. Can debt expenditures which expand the number of people who have access to a given type of technology to increase their real growth be possible? That phenomenon has already occured in this country. "The People" seem richer in financial terms but not in personal, individual terms.