Equity and Stock

Ownership for the legal person.

Rights subordinate to the owners of resource, production, and capital with voting rights sometimes.

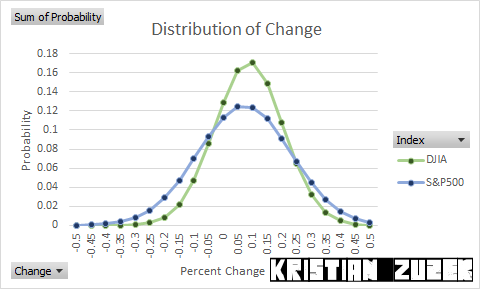

Deviations from the Norm. According to public data:

Historical Summary

| To GDP Ratio | 1990 | 2000 | 2010 | 2020 |

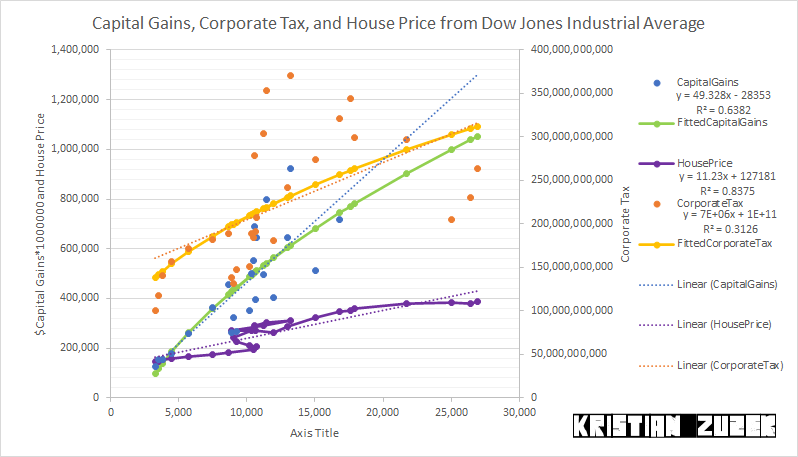

| Corporate Tax | 0.0193573938679371 | 0.0177874357281068 | 0.0144679330477139 | 0.0125934506337519 |

| Income | 0.603836842842108 | 0.581507081872029 | 0.564092069150733 | 0.618129093029936 |

| Retail Sales | 0.317381276454298 | 0.309773159183255 | 0.293772070120358 | 0.298786282204076 |

| Capital Gains | 0.0335751206144662 | 0.0416249884652232 | 0.0327074697867998 | |

| Debt | 0.628188982458451 | 0.61901509361576 | 1.00102634990807 | 1.22039637255581 |

| 30 Year Mortgage Rate | 0.077259787735849 | 0.062905881712627 | 0.0409144448476052 | 0.0311169811320755 |

The United States of America has laws which are tailored to the philosophy and beliefs of The People. There is a theory that corporate taxes should be zero after all costs including wages and salary are accounted then personal incomes will be taxed to the desired level. There is a physical relationship with an expanding empire and population: Once the population begins growing slower than the interest rate for any fixed level of real growth from technology then the new population for each year does not fully underwrite the promises of previous years; Additionally, when an empire, let us assume the dollar empire, was expanding across the globe each dollar of taxable corporate earnings was generated by more people each day compared to domestic population. After the dollar empire reached the limits of diplomacy and willingness to trade then fluctuations, including competitive partners, hostile or allied would decrease the number of foreign population adding to domestic taxable corporate earnings.

The price of equity is a claim to the revenues generated by stocks. When stocks are low due to depressed income then equity prices reflect the decrease in revenues related to the number of goods stocked multiplied by the price of stocks; there are fewer goods at an equal price. With the contracted pension plans, some with large state or public obligations, unable to meet promise delivery often the modern political economy intervenes in the the "free market". The same is true when credit and fraud related decreases in income also decrease demand to the point that an equal stock requires a lower price in order to move stocks of goods from warehouses to retail to buyers.

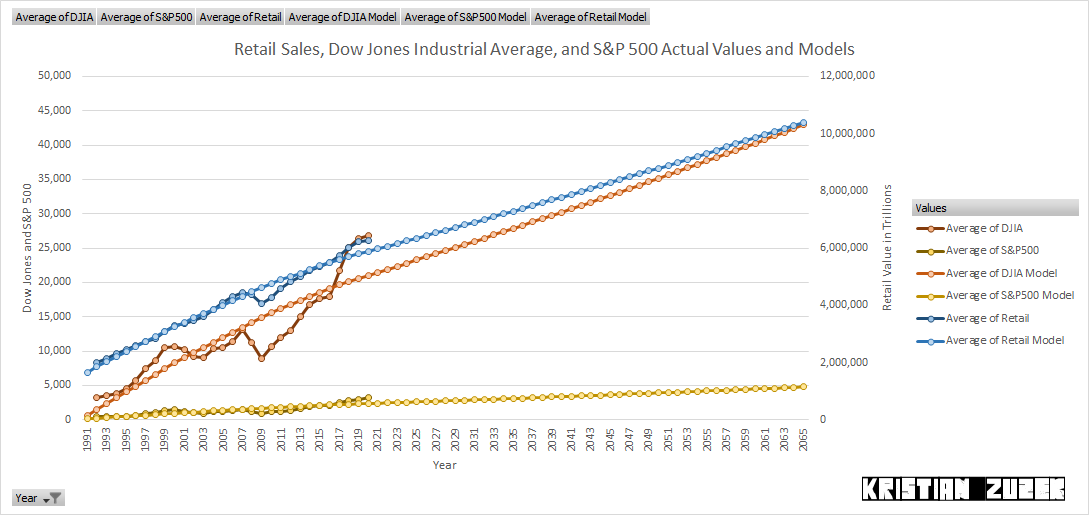

At a given level of consumption the number of goods stocked is relative to the population, thus the retail sales numbers fluctuate with the supply of goods and price of demand. Consequently, the price of equity, the value of aggregate stocks move with retail sales condition upon intervention on "free markets" by the modern political economy.

Conclusion

All three series, Retail Sales, Dow Jones Industrial Average, and S&P500 are valued above their long term relations.Except for massive inflations, deflations; frauds causing revaluation or default; or creation of new legal states there has never been a permanent departure from long term relations of value and worth. The energy and time required to determine these values changes slowly in functioning economies only having real growth when major technologies create a true revaluation.

The world liberalized and then enriched workers, indentured servants, and slaves. The world cleaned industrialization with science. The world was made efficient with computers. There is likely a new techonology that does not yet exist.