World Debt and Interest

Relative value of the future conditioned on the growth of today.

When exchange rates can be a bigger influence than people.

Perceived free money for the elected, appointed, or ascended. It is easy to point a finger at debt and accuse citizens of a democracy of voting to burden all citizens with a common debt. When perpetual growth is assumed often even the most inept policy makers can brush over a previous stroke of richness with a new perception. Observations may vary.

Duplicate Graph.

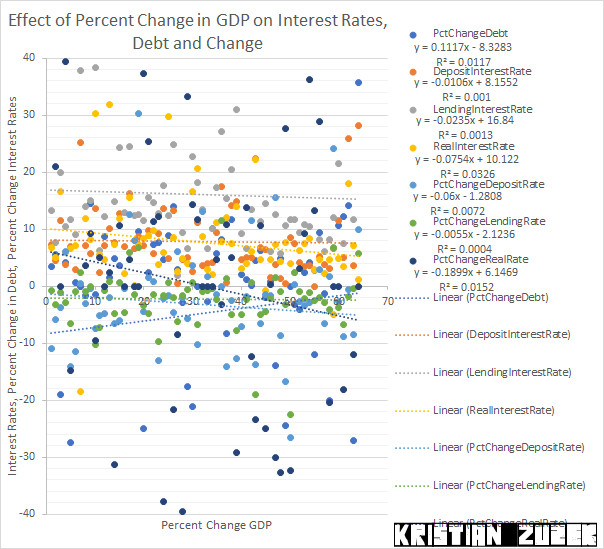

During the full sample period, there is no statistical significance between Percent Change in GDP and all other economic series. Contrast this finding with the Relations to Deposit Rate on the World Tax and Income page which has fewer country's in the sample of data and more statistical significance.

Once again, the division between OECD and non-OECD nations across the duration of time is the most distinct observation.

| Group OECD or Not OECD | 1980 | 1990 | 2000 | 2010 | 2020 |

| Not OECD | 61.15 | 54.24 | 48.51 | ||

| OECD | 41.46 | 47.63 | 73.55 | ||

| Not OECD | 26.63 | 36.73 | -12.69 | 19.35 | |

| OECD | 22.35 | 7.16 | 6.49 | 3.69 | |

| Not OECD | 55.89 | 112.79 | 16.02 | 9.27 | |

| OECD | 20.46 | 13.13 | 6.59 | 4.43 | |

| Not OECD | 259.48 | 3.14 | -7.17 | ||

| OECD | 9.58 | 4.46 | -6.8 | ||

| Not OECD | 8.38 | -0.09 | 3.75 | -1.5 | 4.53 |

| OECD | 5.76 | -6.77 | -2.17 | -4.84 | |

| Not OECD | 6.81 | 4.07 | -0.52 | -1.21 | 0.38 |

| OECD | 1.64 | -4.45 | -3.27 | -2.96 | |

| Not OECD | -388.14 | 19.59 | -26.64 | -30.02 | |

| OECD | -249.89 | 3.3 | -2.43 | -10.33 | |

The continued global trend of decreasing interest rates, decreasing population growth, and decreasing financial and accounting value change. Does economic growth exist?

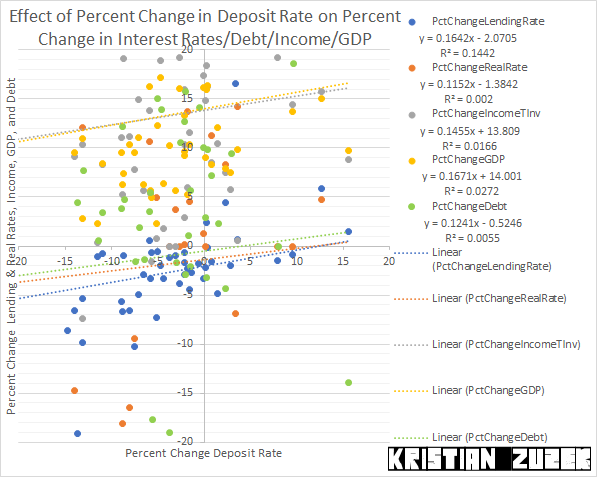

Financial and accounting value change are becoming smaller magnitudes of change yet they are still positive numbers. The above graph shows that the majority of deposit rate change observations are negative.

Conclusion

As long as population growth exists and interest rates are above zero, then politicians can promise the world to voters and voters can pretend to believe perpetual wealth.Dictators have less promising to make but are still constrained by the same reality of zero percent interest rate floors. If they reign over high growth nations then also high are their usually non-OECD interest rates.

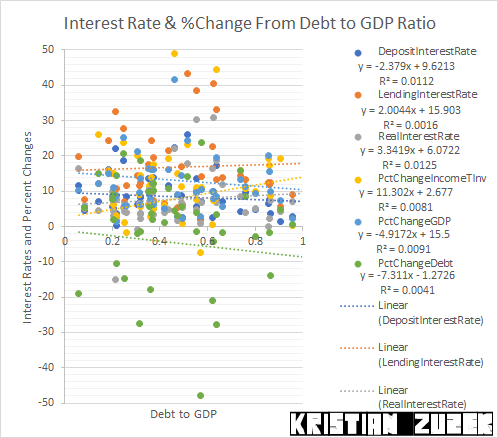

As the top graph shows, over the period the large reductions in debt can occur at any Debt to GDP ratio but tend to be bigger when the ratio is higher. In reality these major decreases occur when a year of Debt Expenditure is not executed due to inability to pay interest. Extremely rare in rich, developed economies which will simply decrease interest rates of depress parts of their domestic economies to maintain debt expansion for the purpose of perceived aggregate economic growth.