World Budget and Gross Domestic Product

Gold, money, credit, and numbers.

Integrated not Diversified.

Local Currency.

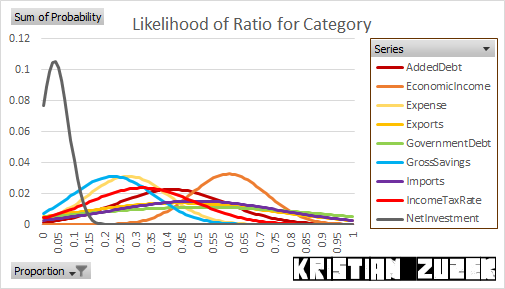

As a percent of Gross Domestic Product, the following financial and accounting categories have mean and standard deviation as the following table:

| Mean | Std.Dev. | |

| IncomeTaxRate | 0.32018233730928 | 0.173382758757981 |

| AddedDebt | 0.415252870955863 | 0.176601156599831 |

| EconomicIncome | 0.598888507924771 | 0.121809248867721 |

| GrossSavings | 0.226043926915049 | 0.133655689915932 |

| NetInvestment | 0.0367376944120664 | 0.0459990548170734 |

| Imports | 0.49473162328092 | 0.271132961216599 |

| Exports | 0.435413212897492 | 0.308754578601369 |

| Expense | 0.274610130913154 | 0.129433551887247 |

| GovernmentDebt | 0.510702699179774 | 0.392408706303327 |

Current Summary

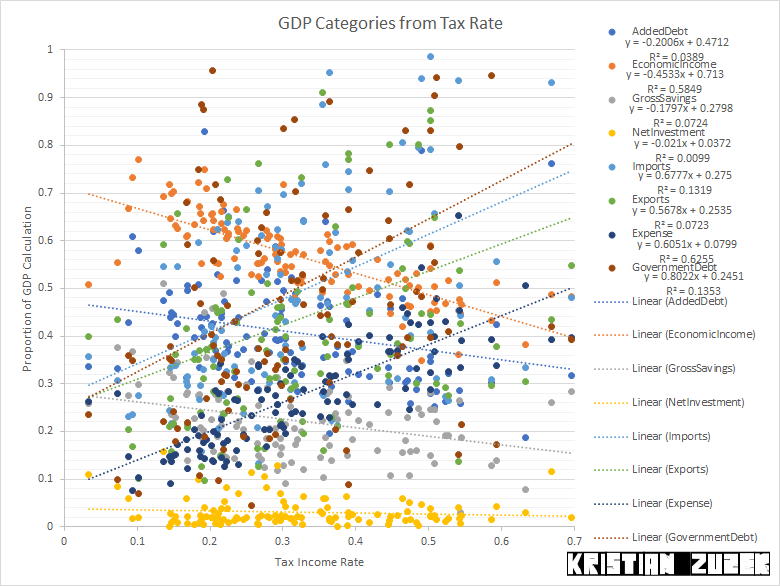

Two series have statistical relations with Tax Collection as a Percent of Income: Unsurprisingly the ratio of Economic Income to GDP, which is Gross Income Adjusted to remove non-person income such as corporate and financial income divided by GDP; and Debt divided by GDP. Their signs move in opposite directions. Debt goes up and income goes down when tax collection is higher.

Does a theoretically perfect economy exist?

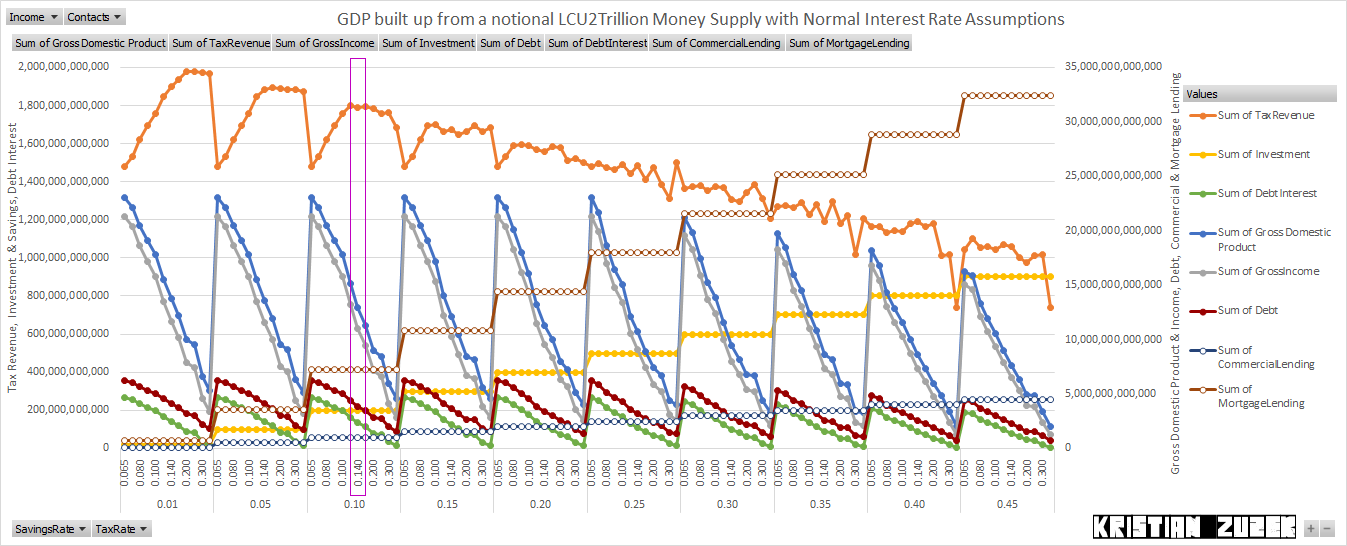

If an objective is set to determine the maximum yearly tax collection from a money supply then the expected values of other financial and accounting series can be derived from notional regulated deposit minimums. In this example, Commercial banks are requied to have 10% of deposits relative to their lending. Mortgage lending is the yearly revenue from an entire set of mortgage loans. According to the calculations, constrained by a 10% savings rate, the optimal tax rates for reclaiming money supply each year are 12%, 14%, and 16%. This would create a notional economy as the following graph and table:

| Tax | 0.12 |

| Gross Domestic Product | 15160543834546 |

| TaxRevenue | 1799682867670 |

| GrossIncome | 13197674362913 |

| Investment | 200000000000 |

| Saving | 200000000000 |

| Debt | 4434418585939 |

| DebtInterest | 163186603963 |

| CommercialLending | 1000000000000 |

| MortgageLending | 7200000000000 |

| Assumed Trade Balance | 0 |

| Exports | as Imports |

| Imports | as Exports |

Conclusion

A notional tax revenue maximizing economy assumes away the previous mistakes and promises operating economies experience the burden of.The legal framework of operating nations determine their fixed and variable financing.

The wealth inherent of a nation is not necessarily reflected by Local Currency Units or Power Purchasing Parity but can at time be witnessed in Foreign Exchange markets when allowed by international finance and accounting laws.